Homeowners Insurance in and around Wrightsville

Protect what's important from catastrophe.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance is necessary for many reasons. It protects both your home and your precious belongings. If you experience a burglary or a fire, you might have damage to the items in your home as well as damage to the structure itself. Without adequate coverage, you won't get any money to replace your things. Some of your belongings can be covered if they are lost or damaged outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

Protect what's important from catastrophe.

Apply for homeowners insurance with State Farm

Safeguard Your Greatest Asset

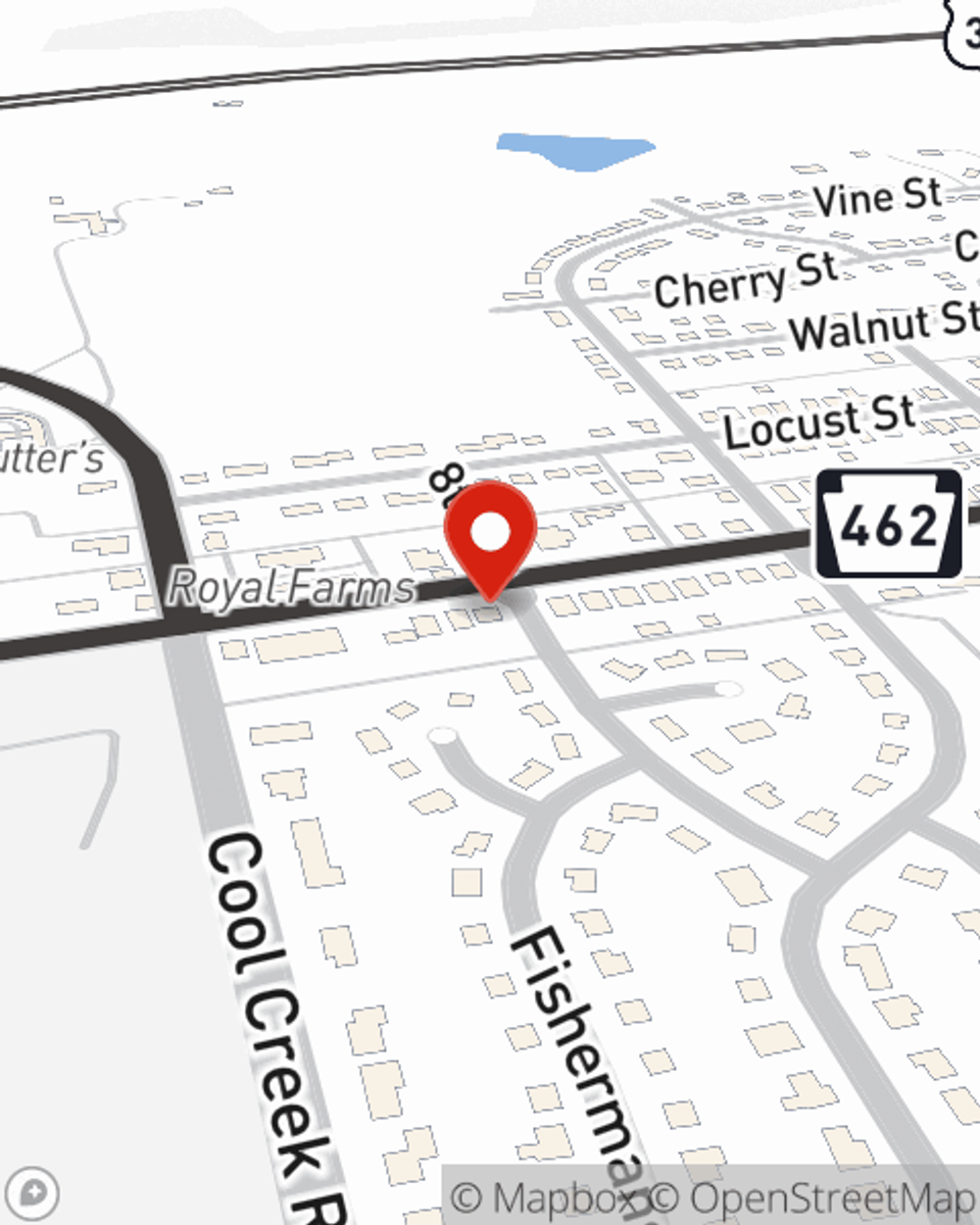

Great coverage like this is why Wrightsville homeowners choose State Farm insurance. State Farm Agent Monica Markley can offer coverage options for the level of coverage you have in mind. If troubles like service line repair, wind and hail damage or sewer backups find you, Agent Monica Markley can be there to help you file your claim.

Ready for some help understanding the policy that's right for you? Call or email agent Monica Markley's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Monica at (717) 252-3656 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.

Monica Markley

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.